Are you a connector or community leader looking for a way to activate mentors, experts and other contacts that isn’t time-consuming for you or your network?

Great for accelerators, community groups, incubators, mentor networks…

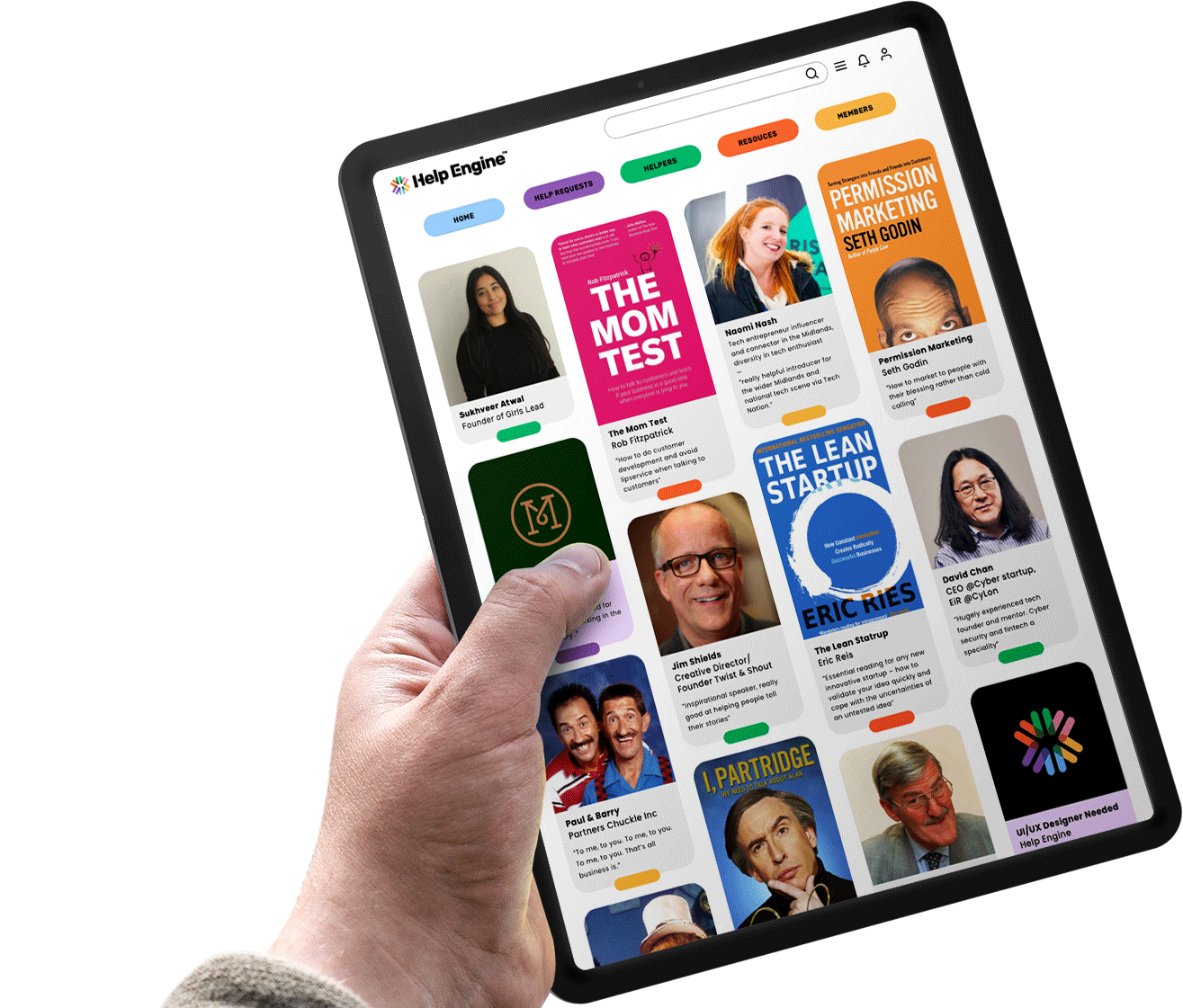

Curate an amazing network

Create a searchable list of mentors, contacts and resources really quickly. Helpers describe themselves in their own words to ensure the best matches.

Create a Help Engine

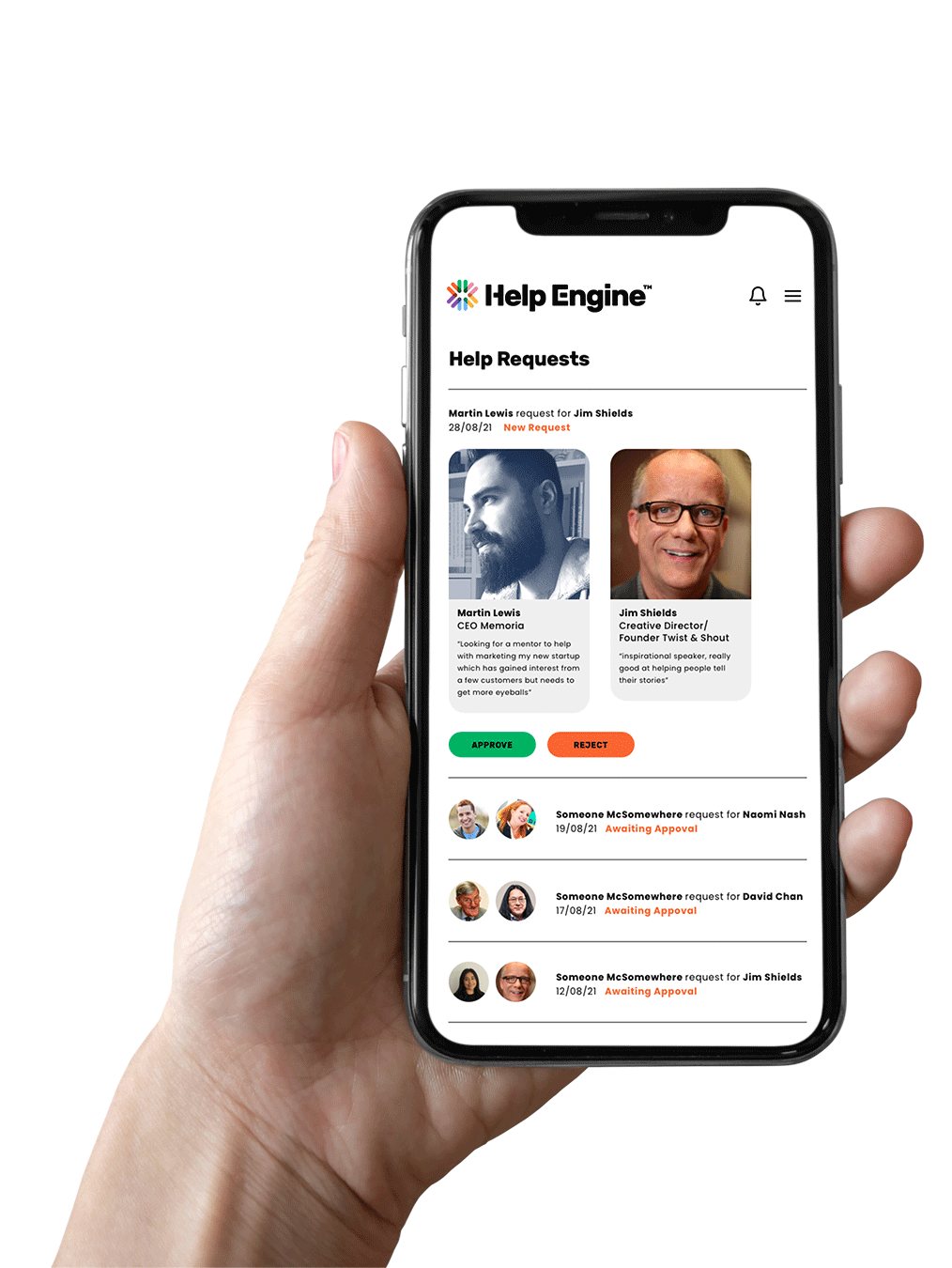

Introductions without the hassle

Avoid time-consuming manual introductions via email or social media. Our self-service platform lets community members request intros – you just need to approve them.

Create a Help Engine

Protect your contacts

Nobody likes unsolicited requests from strangers. Control who contacts whom so that nobody’s time is wasted. Includes an anonymity option for helpers.

Create a Help Engine

Happy Users...

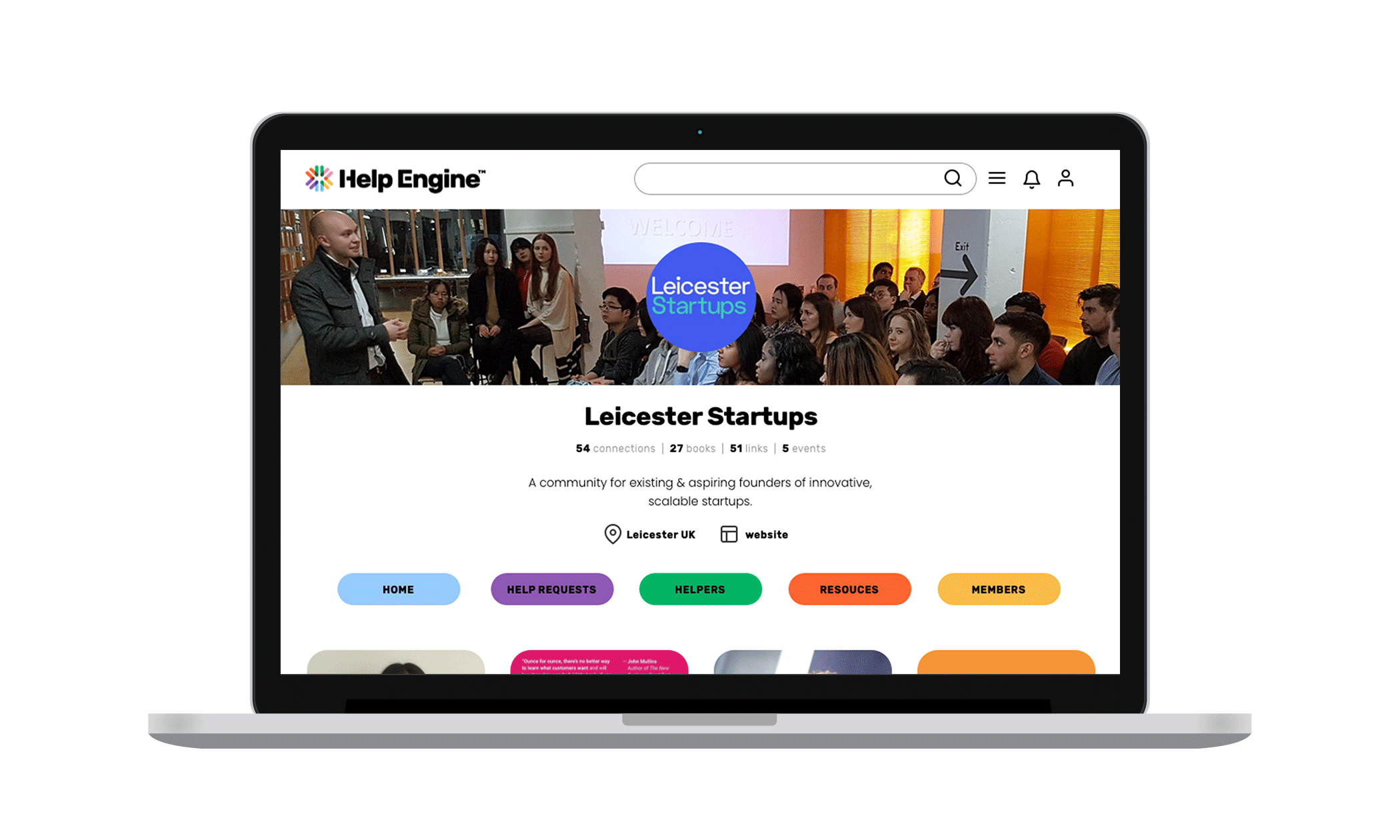

Sam Larke

Comunity Manager

Leicester Startups CIC

“Help Engine has been instrumental in activating hard-to-reach mentors for our accelerator program. Is makes it much easier for my team to moderate introduction requests - no more spreadsheets and emails!”

“

Sophie Hainsworth

CEO

LoyalFree

“I love giving back to my local business community through mentoring and introductions but this can be a challenge with limited time to organise these. Our local Help Engine has connected me with well-matched mentees in a simple and effective way.”

“

Lee Paxman-Clarke

De Montfort University

Crucible Entrepreneurship Programme

“Help Engine has enabled us to connect our cohort of entrepreneurs with our select network of business experts. With just a click of a button they can request the support they need within our programme.”